- 714.396.2819

- Email Me

- My Dashboard

Advanced Search

What Happens to Affordability When Interest Rates Increase?

What happens to home buying affordability when interest rates increase? In short, buyers purchasing power drops considerably the longer they wait to buy.

Purchasing Power: An increase in interest rates by 1% translates to an 11% drop in the home a buyer is able to afford. For the past several years, experts and prognosticators across the country had been calling for increasing interest rates. Yet, it never really materialized. To many it was reminiscent of Chicken Little’s, “THE SKY IS FALLING!!” Sure interest rates had their ups and downs, but, in the end, they consistently dropped back down to historical lows, below 4%. That is, until this year.

With the election of President Trump in November 2016, interest rates rose significantly, climbing nearly 1% overnight. The new presidential administration was poised to lower taxes, increase spending on infrastructure, and reform trade around the world. These policies were seen as extremely inflationary and resulted in increasing rates. As financial markets realized that the policies were not going to occur overnight, once again, interest rates dropped below 4%.

It wasn’t unit the end of 2017 where the rubber started meeting the road with the passing of the new tax law. Interest rates responded almost immediately and began to climb. With the announcement of trade reform and a trillion-dollar infrastructure plan, there is tremendous pressure on rates today.

The experts and prognosticators may have had their timing off, but they collectively understood that it was not a matter of “if” interest rates would rise, but “when” they would rise. With the massive manipulation of the monetary policy by the Federal Reserve, the United States has been in economic, uncharted waters, making the art of forecasting rates not an exact science.

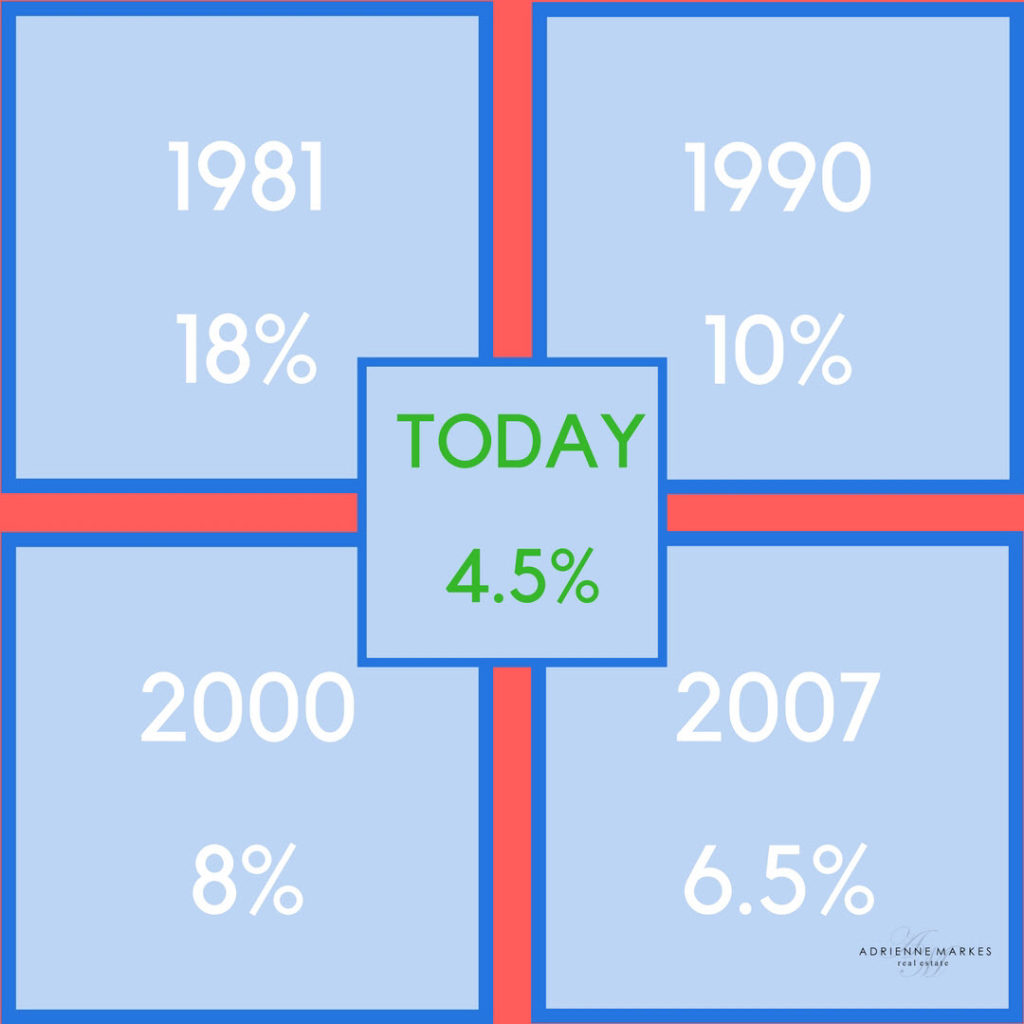

At this point, the pressure on interest rates to rise is real. But, after more than a decade of extremely affordable rates, everybody has become accustom to these affordable levels. It is time for a brief history lesson:

Yes, 3.5% is a better rate; however, 4.5% is still a very low rate in historical context. Buyers should not wait for another drop. Instead, they should cash in on today’s mortgage rates. These low levels are an absolute gift based upon the economic history book.

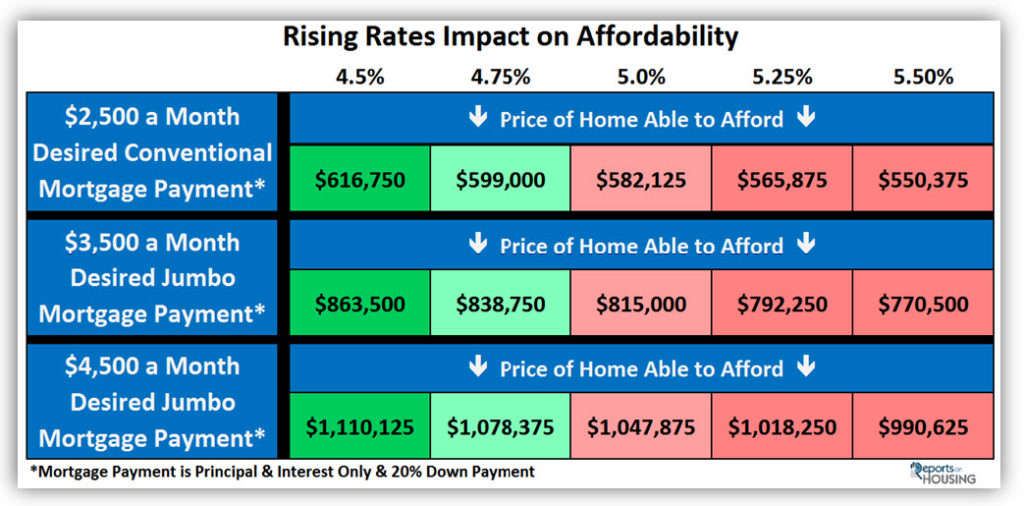

Buyers must understand that the longer they wait to purchase, the greater the risk that rates will rise. As they rise, a buyer’s purchasing power erodes considerably the higher then climb. If mortgage rates climbed by 1% from where they are today, buyers looking for a $2,500 monthly payment would see their purchase power drop from $616,750 to $550,375; that’s a $66,375 drop in purchase price. For buyers looking for a $3,500 monthly payment, it drops from $863,500 to $770,500, a drop of $93,000. And, for buyers looking at a $4,500 monthly payment, it drops from $1,110,125 to $990,625, plunging by nearly $120,000.

Keep in mind, 5.5% is still a very low rate. The trouble is there are younger buyers in the marketplace who have never experienced rates above 5%. The housing market is not going to implode. It will not be the end of the world. But, it will eat into affordability and purchasing power. That 1% increase in mortgage rates will result in an 11% drop is what a buyer is able to afford.

With an improving economy, the new tax law, trade reform, and a new infrastructure plan, expect rates to rise. Buyers should not sit on the sideline and wait for them to drop. If they do, they will watch their purchase power crumble.

If you, or someone you know, are ready to stop renting and start owning, you can get visibility to loan programs available and receive a free list of affordable homes for sale sent to your email by clicking here.