- 714.396.2819

- Email Me

- My Dashboard

Advanced Search

Surfs Up! Orange County Market Summary January 2017

After a slow start to housing due to very few homeowners placing their homes on the market at the beginning of the month, everything that is coming on the market now is flying off the market almost as quick as the “FOR SALE” sign is placed in the front yard. The only complaint in the real estate trenches is that there are simply not enough homes on the market right now. As they saying goes, “surfs up” in the OC real estate market.

Here is a quick recap of the first month of 2017s Orange County real estate market activity. A more detailed post will follow soon.

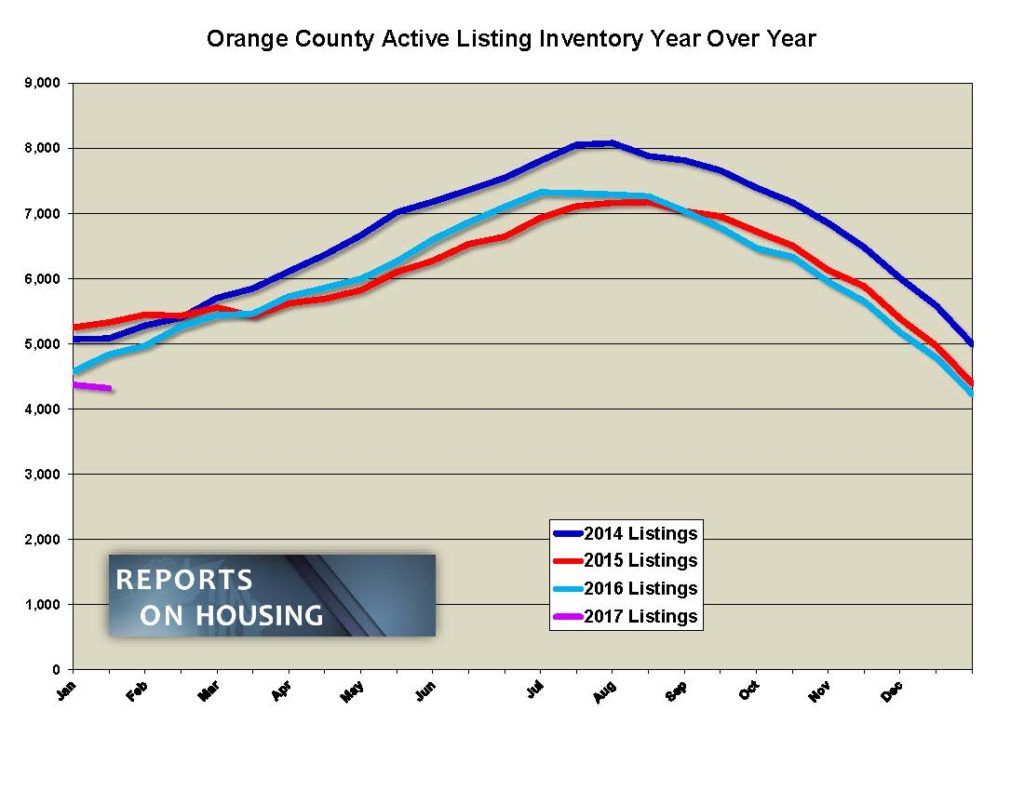

• The active listing inventory dropped by 56 homes in the past couple of weeks, a 1% drop, and now totals 4,320. The drop was unprecedented for this time of the year and is most likely due to fewer homes coming on the market so far in 2017, down 6% from last year. The inventory should increase from here, peaking sometime during the summer.

• There are 32% fewer homes on the market below $500,000 compared to last year at this time and demand is down by 16%. Fewer and fewer homes and condominiums can now be found priced below $500,000. It is the price range that is slowly disappearing.

• Demand, the number of pending sales over the prior month, skyrocketed by 24% in the past couple of weeks, adding an additional 368 and now totals 1,930. Today’s demand is almost identical to last year when there were just 6 additional pending sales. The average pending price is $871,107.

• The average list price for all of Orange County is $1.6 million, identical to two weeks ago. This number is so high due to the mix of homes in the luxury ranges that sit on the market.

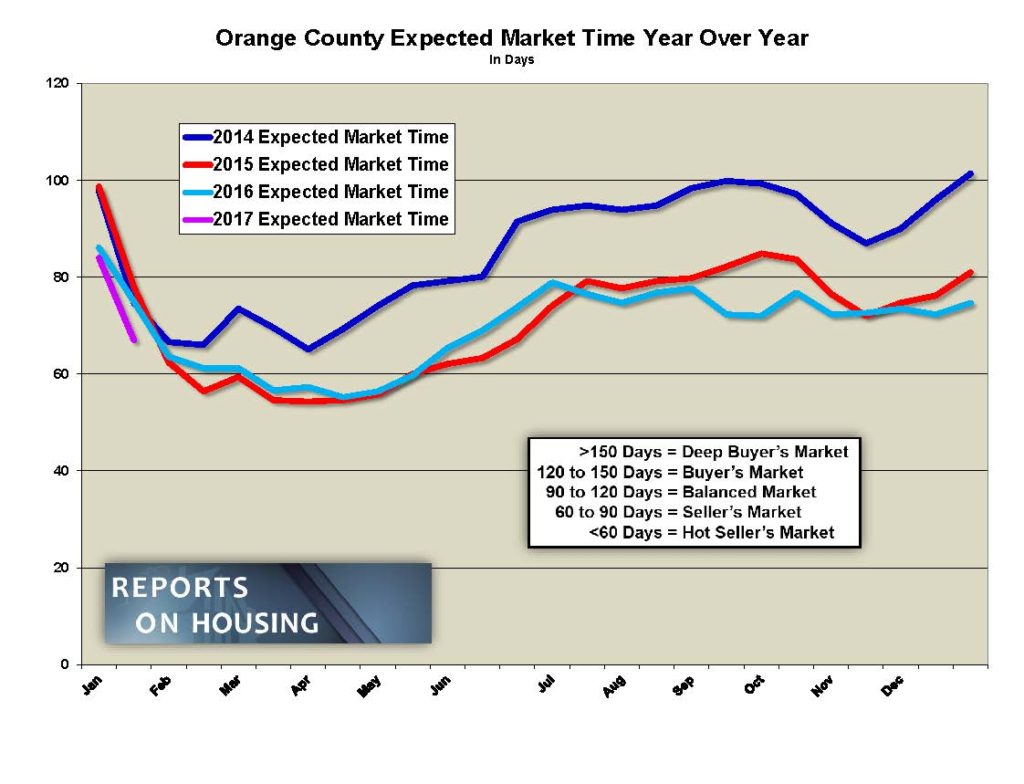

• For homes priced below $750,000, the market is HOT with an expected market time of just 42 days. This range represents 42% of the active inventory and 67% of demand.

• For homes priced between $750,000 and $1 million, the expected market time is 73 days, a slight seller’s market (between 60 and 90 days). This range represents 18% of the active inventory and 16% of demand.

• For luxury homes priced between $1 million to $1.5 million, the expected market time is at 98 days, dropping by 49 in the past couple of weeks. For homes priced between $1.5 million to $2 million, the expected market time increased from 169 to 195 days. For luxury homes priced above $2 million, the expected market time decreased from 370 to 277 days.

• The luxury end, all homes above $1 million, accounts for 40% of the inventory and only 17% of demand.

• The luxury end, all homes above $1 million, accounts for 40% of the inventory and only 17% of demand.

• The expected market time for all homes in Orange County drastically dropped in the past couple of weeks from 84 to 67, a slight seller’s market (between 60 and 90 days).

• Distressed homes, both short sales and foreclosures combined, make up only 2.1% of all listings and 3.9% of demand. There are 38 foreclosures and 53 short sales available to purchase today in all of Orange County, that’s 91 total distressed homes on the active market, 21 fewer than two weeks ago and the lowest total since prior to the Great Recession. Last year there were 159 total distressed sales, 74% more.

• There were 2,474 closed sales in December, a 1% increase from November, and nearly identical to the 2,746 sales that closed in December 2015. The sales to list price ratio was 97.3% for all of Orange County. Foreclosures accounted for just 1.25% of all closed sales and short sales accounted for 1.25% as well. That means that 97.5% of all sales were good ol’ fashioned equity sellers.