- 714.396.2819

- Email Me

- My Dashboard

Advanced Search

Orange County’s Autumn Market Will Be Hot Hot Hot

With an extremely low inventory and blistering demand, the Autumn Market is poised to be the hottest in years!

It is that time of the year. Have you seen all of the signs? The leaves are starting to fall, the kids are back in school, and Costco already has Halloween costumes. That is right, autumn is here. The official start to autumn is not until Friday, September 22, but all of the signs are here.

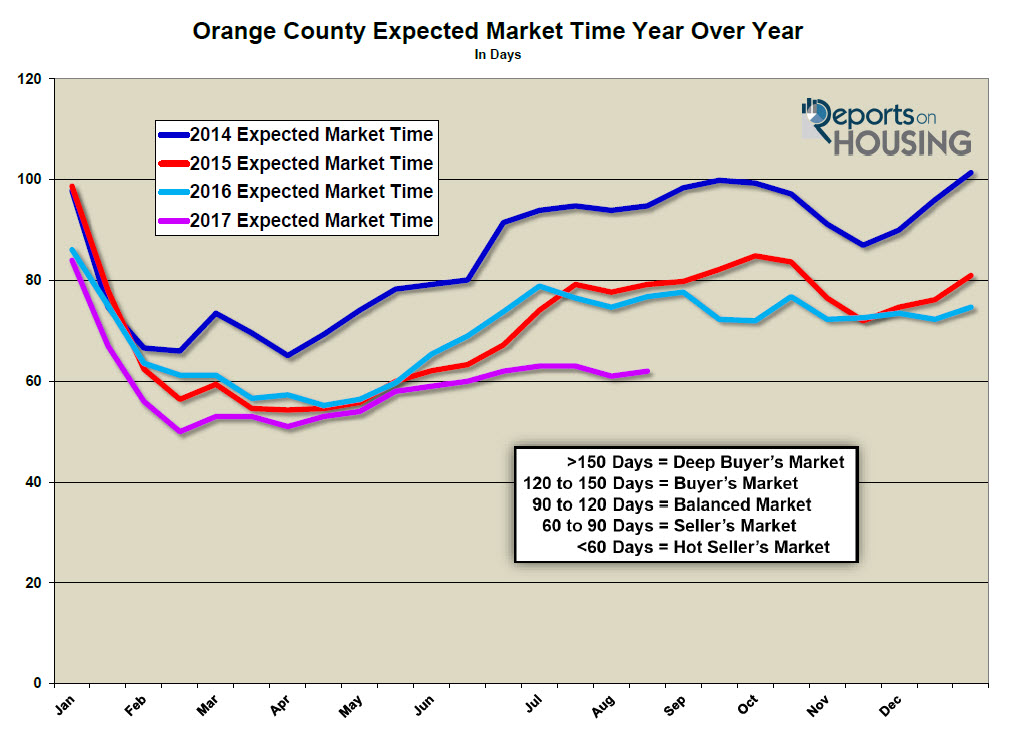

As for Orange County housing, the Autumn Market typically starts around the end of August when the kids head back to their classrooms. It’s no longer the “prime” season for real estate. Both the Spring and Summer Markets are in the past. Housing will now shift gears and transition to a slower time of the year. This year will not be an exception, demand will fall, sales will fall, and the expected market time will start to rise. Nevertheless, this year will be the hottest Autumn Market since 2005.

Today, there are 19% fewer FOR SALE signs on the active listing inventory right now compared to last year at this time. In fact, the last time the supply of homes was this low at the end of August dates back to 2012 when the active inventory was dropping like a rock. And, in spite of this year being the second fewest number of homeowners opting to place their homes on the market this century (2012 was the lowest), demand has remained strong. Demand, the number of new pending sales over the prior month, is still at end of March levels. As a result, the current expected market time is at levels not seen since 2013.

The expected market time takes into account both supply and demand. It is the amount of time a seller can expect to be on the market before opening up escrow. It is the velocity of the market as a whole. Todays expected market time is 62 days, 19% lower than last year’s 77 days. At 62 days, all of Orange County it is a seller’s market. It is no longer a HOT seller’s market, below 60 days, as it was from the end of January to the middle of June of this year, but it is still hotter than July’s 63 day expected market time.

Everything priced below the $1 million mark, is flying off the shelves. The expected market time for homes priced below $500,000 is 34 days. Now that is hot! Above $1 million is a bit of different story, the higher the price, the slower the market. For homes priced above $4 million, the expected market time rises to 462 days.

From here, we can expect the active listing inventory to continue to fall throughout the remainder of 2017. Demand, in terms of new pending sales, will slowly but surely drop throughout the Autumn Market. It will then drop like a rock from Thanksgiving through the end of the year. With both the inventory and demand dropping, the expected market time will only rise slightly for the remainder of the year.

A warning for sellers: do not stretch the asking price much at all. Word from the real estate trenches indicates that many homeowners in the lower ranges are sitting on the market with very little activity and no offers to purchase because of price. In spite of the hotter real estate market, buyers are not willing to overpay for a property. As a seller, if you have been on the market for a while and the number of buyer showings has dropped considerably, the market is speaking to you. It is most likely the price. Homes that are priced well, taking into consideration condition, upgrades, and location, will attract offers to purchase.

A warning for buyers: do not expect the market dynamics to change much in the coming months. Even with a drop in buyer demand during the autumn and Holiday Markets, meaning less buyer competition, there will also be a drop in the number of homeowners placing their homes on the market. Many homeowners will opt to pull their homes off of the market now that both the Spring and Summer Markets are in the rear view mirror. Ultimately, there will be fewer choices. With a drop in both supply and demand at the same time, the expected market time will not fluctuate much.