- 714.396.2819

- Email Me

- My Dashboard

Advanced Search

Have You Received Your OC Property Value Notice 2017-2018 Tax Year?

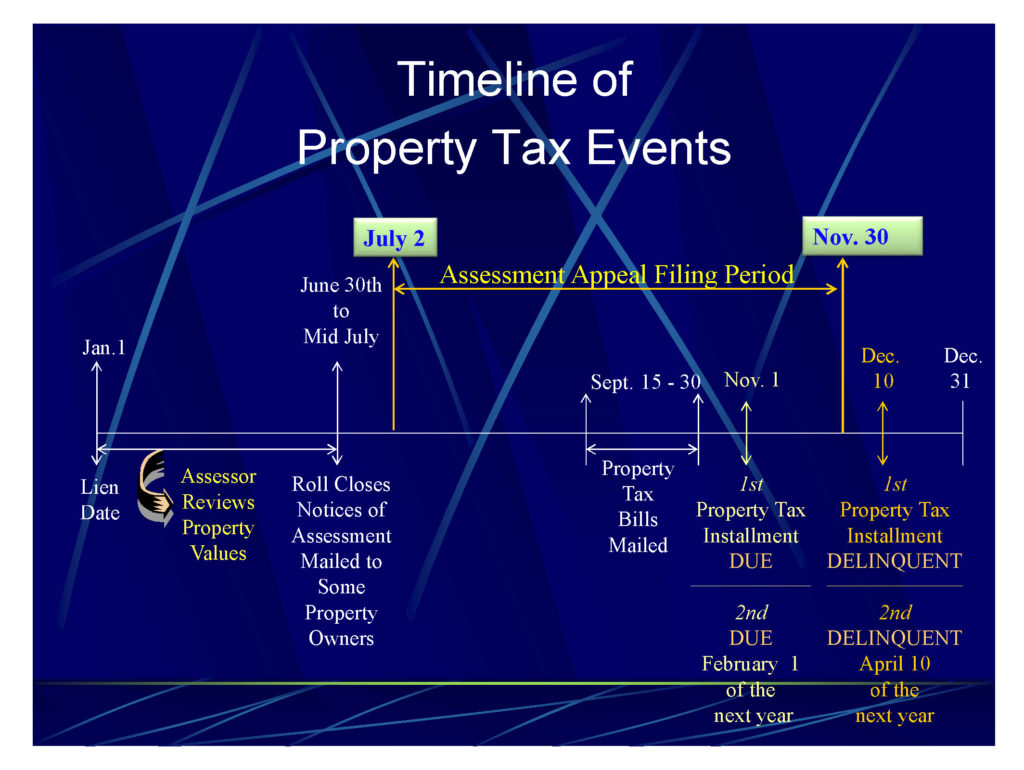

The Orange County Assessor’s office has mailed out the Property Value Notices for the 2017-2018 tax year. Along with this notice you will also receive an information sheet that reviews market value, Prop 13 value and Prop 8 value. Also keep an eye out for a supplemental assessment notice if you recently purchased your property or have done home improvements to your property. Not everyone will get one, only those who own properties that the assessors office feels have increase in value or decreased in value.

After reviewing my property assessment, the assessors office has notified me that the bill I will receive this fall will be based on the Proposition 13 factored base year value. It is based on market value of the property when I bought it, PLUS any new construction, PLUS inflation of no more than 2% per year. The assessors office has imposed a 4.758% increase in my assessed value over last year. You better believe I’m going to request an appeal! And you can too!

If you received a notice from the assessors office increase the value of your home, you can request a review of your property value for free. The form I received states:

“If you disagree with the valuation of your property, you may file and assessment appeal between July 2 – Nov 30 (the new extended appeal date)”

If the assessed value exceeds what your property could easily sell for in today’s market, then you should definitely consider filing an appeal.

You can get an application to appeal the new value of your property. Click here for instructions on how to appeal your property value. Part of your appeal application and hearing with the Clerk of the Board of Supervisors must include evidence as to the market value of your property for January 1, 2017. If you need help with finding the qualified comparable sales within the required time frame for your appeal process, you can fill out a request form here to request a report and it will be emailed you.

You should know that even if you appeal, you still need to pay any taxes due during the appeal process. If you don’t live in Orange County, no worries! Each county has different procedures, so look for your So Cal county below and click then link for more info. Yes, I can provide your evidence for any of the counties listed below along with select Nor Cal counties as well.

Los Angeles County Appeal Info

San Bernardino County Appeal Info

And now for a little humor….