by Adrienne Markes

On May 8, 2017

Listed in Blog>Market Condition, Blog>Seller Info, Real Estate News

On May 8, 2017

Listed in Blog>Market Condition, Blog>Seller Info, Real Estate News

The luxury market in Orange county is taking some heat and NOT the same kind of “on fire” heat we are seeing in lower priced homes.

Bloomberg exclaims how home buyers face bidding wars on “scarcer-than-ever” U.S. listings. CNBC describes spring housing as the “strongest seller’s market ever.” The Wall Street Journal reports that U.S. home resales spiked to hit a 10-year high. It’s no wonder that luxury homeowners list their homes with high expectation. The issue is that none of these headlines applies to luxury real estate.

Bloomberg, CNBC, and The Wall Street Journal are all reporting on the national market. They are illustrating how there is no inventory, that homes are generating multiple offers, that homes prices are rising through the roof. They are NOT reporting on the luxury market; instead, they are reporting the overall market. The national median sales price for a home was $273,000 in March. In Orange County, it was $665,000. These medians don’t even come close to local luxury.

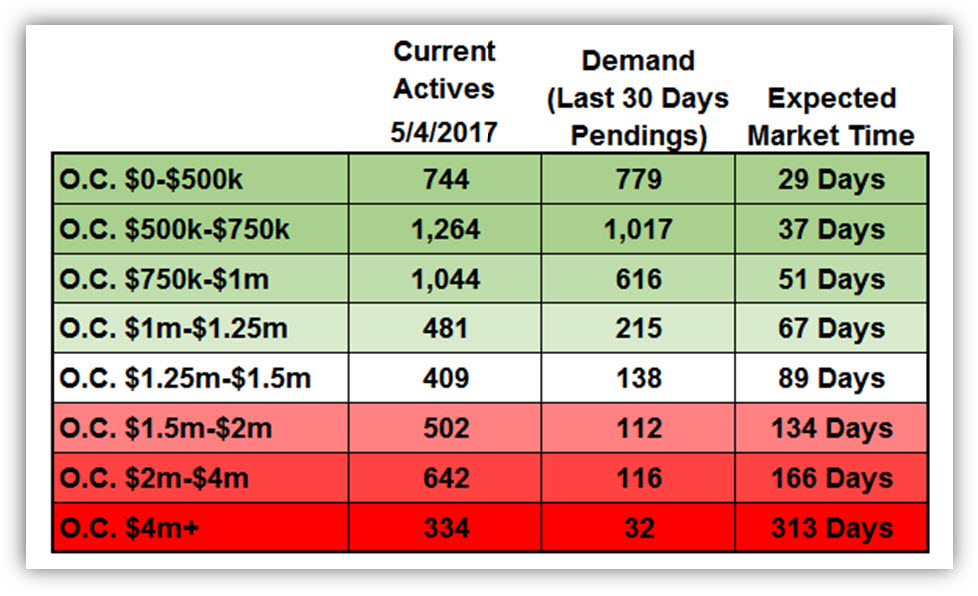

A seller’s market occurs when the expected market time is below 90 days. A sizzling hot seller’s market is when the expected market time falls below 60 days. The overall market in Orange County is currently at 54 days, red-hot. The lower ranges are firing on all cylinders.

In Orange County, luxury housing (defined as the top 10% of recent closed sales) starts at $1.25 million. With the exception of homes priced between $1.25 million and $1.5 million, the upper ranges are actually within “Buyer’s Market” territory. When the expected market time, the amount of time it would take to place a home into escrow if it were listed FOR SALE today, exceeds 120 days, it is considered a buyer’s market.

This chart illustrates how the market slows as the price ranges rise. Homes that are more expensive take a lot longer to sell. This is simply because there are fewer and fewer potential buyers that can afford a home as prices rise. There is pent up demand with not enough homes on the market within the lower ranges. That’s why they entertain multiple offers and home values have been on the rise. Yet, homes in the upper ranges sit and often do not find success. Many luxury homes remain on the market for months, and, in some cases, years.

It all boils down to supply and demand. The lower ranges do not have enough supply, and demand is through the roof. Buyers need to sharpen their pencils and write strong offers to purchase. Buyers have to fight in order to win. They fight by offering the best price and terms.

The opposite is true for the luxury market. There are not enough buyers coupled with plenty of seller competition. Sellers have to fight for the limited number of buyers in the marketplace. They fight by offering the best price and terms. They may need to work with potential buyers who need to sell their home first as a contingency of buying a luxury home. For luxury sellers, if the price of a home is not compelling they will not find success. When a home is priced well, it attracts attention.

In most cases, success is determined by motivation. Many luxury sellers claim that they “don’t have to sell” to help rationalize their price. They stretch their asking price and sit on the market, generating little activity and no offers. Yet, sellers who sharpen their pencil when it comes to price are much more likely to achieve their objective in selling.

Luxury sellers should ignore real estate headlines; instead, they should focus on the data and statistics that are specific to the upper end and rely on the expertise of a professional REALTOR® to help them navigate the challenging luxury home market.

In the past two weeks, demand for homes above $1.25 million decreased from 413 to 398 pending sales, a 4% drop. The luxury home inventory increased from 1,846 homes to 1,887, up 2%.

For homes priced between $1.25 million and $1.5 million, the expected market time is at 89 days. For homes priced between $1.5 million to $2 million, the expected market time increased from 116 to 134 days. In addition, for homes priced above $2 million, the expected market time increased from 189 days to 198 days. At 198 days, a seller would be looking at placing their home in escrow around mid-November.