by Adrienne Markes

On Mar 13, 2017

Listed in Blog>Buyer Info, Blog>Market Condition, Real Estate News

On Mar 13, 2017

Listed in Blog>Buyer Info, Blog>Market Condition, Real Estate News

Interest rates are expected to rise, this means buyers can afford a higher purchase price now than the will be able to afford later, once rates have gone up. Home affordability is slowly being squeezed out of the Orange County market and So Cal in general.

The United States economy is finally revving its massive engine. Jobs are beating expectations; unemployment has fallen to near pre-recession levels; wages are rising at the fastest pace in years; and, inflation is on the rise. In addition, the new, Trump administration is planning to ramp up infrastructure spending, lower taxes, and focus on jobs, all heavily contributing to much higher inflation expectations. As a result, the Federal Reserve is expected to once again raise the Federal Funds rate this week, which has already had an impact on mortgage rates, rising to a 2017 height.

With all of this positive economic news, what does it mean for the future of interest rates? The historically low 3.5% mortgage rates are officially in the rear view mirror, a chapter in the history books of the housing recovery. Buyers should not wait around for those rates to return. Instead, cashing in on today’s mortgage rate, still historically low, is a wise strategy.

Unfortunately, everybody has become accustom to a low interest rate environment. For proper perspective, in 1990 the interest rate was at 10%. In 2000, it was at 8%. Moreover, just prior to the Great Recession, the interest rate was at 6.4%. No, today’s rates are not as low as last October, but they are still a bargain compared to where they have been over the past 50 years.

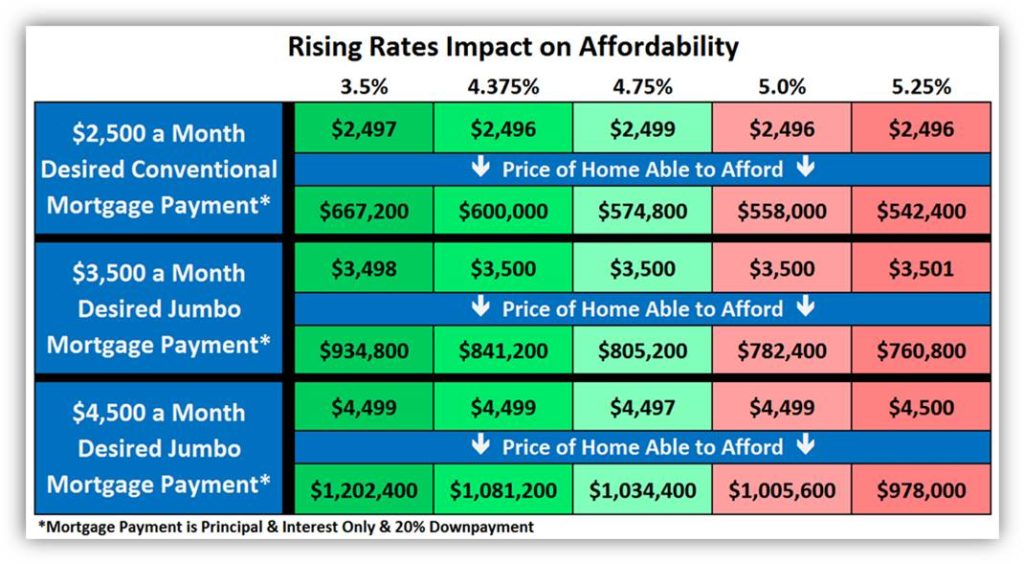

It is imperative that buyers understand that the longer they wait to purchase, the greater the risk that rates will rise. As they rise, affordability erodes. For example, if a buyer can afford a $2,500 monthly mortgage payment with 20% down, they could have purchased a $667,000 home last October with a 3.5% rate. Today, with conventional rates at 4.375%, the purchase price drops to $600,000. As rates rise further, purchasing power continues to crumble. At 4.75%, the $2,500 payment buys a $575,000 home. At 5%, it drops to $558,000. And, at 5.25%, it becomes a $542,000 home, $125,000 less than five-months ago.

For jumbo loans, loans above $636,150, today’s rates are at 4.75%. They were at 4.375% just prior to last November’s presidential election. As a result, if a buyer can afford a mortgage payment of $4,500 per month, they are looking at a $1,034,000 home today compared to a $1,081,000 home back in October. Similarly, as rates rise to 5% and then 5.25%, the purchase price continues to drop. At 5.25%, it becomes a $978,000 home, $103,000 less than five-months ago.

The current Orange County housing market is sizzling hot with very low inventory and demand through the roof. A lot of what is driving demand is the desire to jump on today’s historically low interest rates before they rise, grinding down a buyer’s purchasing power. Securing a low rate now allows buyers to get more house for their money and allows sellers to get a slightly better price before more competition will be out there in the spring and summer markets.