by Adrienne Markes

On Mar 25, 2019

Listed in Blog>Buyer Info, Blog>Market Condition, Blog>Seller Info

On Mar 25, 2019

Listed in Blog>Buyer Info, Blog>Market Condition, Blog>Seller Info

The last several months have been huge for interest rates. Since November 2018, interest rates have dropped dramatically from 5% to 4.25%, a substantial difference that helps on the home buyer affordability front. Today’s rate of 4.25% is the lowest since February 2018.

What happened? The United States economy is showing signs of slowing, there has been an international economic slowdown, the price of oil has dropped substantially, the trade war seems as if there is no end in sight, and there has been tremendous stock market volatility. That is enough for investors around the world to park their money in long term U.S. government bonds. When this happens, interest rates fall. And, last week, the Federal Reserve stated that they were done raising the short-term rate and will not make a move on rates at all in 2020 (maybe one).

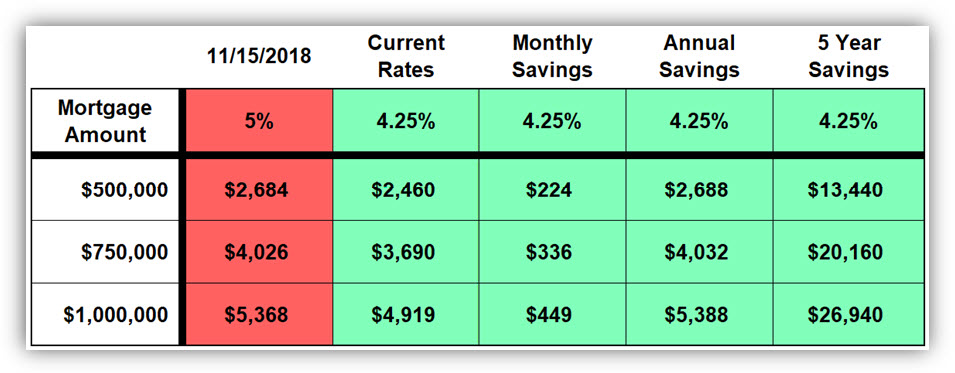

As a result, interest rates have dropped to new lows not seen in over a year. For buyers looking at a $500,000 mortgage, the drop has resulted in a savings of $224 per month compared to last November. That is an annual savings of $2,688, or $13,440 in 5 years. The savings are even more substantial for higher mortgage amounts.

This is where buyers need to understand that right NOW is an excellent time to cash in on today’s low interest rate. Waiting for interest rates to drop further is a lot like gambling. Reminiscing about the good ‘ol days when interest rates were in the mid-3% range will not magically make rates drop. Could they go down further? Perhaps. Could they go up again? Absolutely. The old saying, “a bird in the hand is worth two in the bush” applies. It is better to cash in today than to risk losing out on this opportunity by hoping rates fall further. There are plenty of stories of buyers who have kicked themselves for waiting too long.

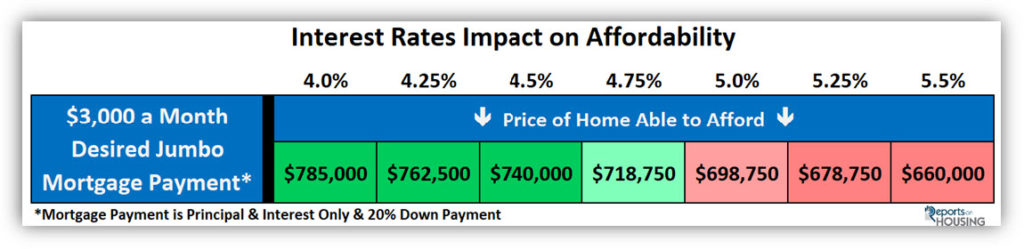

In taking a closer look at affordability, for buyers looking for a $3,000 mortgage payment, along with a 20% down payment, the drop in interest rates has allowed them to afford a much larger home. Back in November 2018, they were looking at a $698,750 home with a 5% mortgage. That has improved spectacularly since. With today’s 4.25% interest rate, a buyer is now looking at purchasing a $762,500 home. That is an amazing increase of $63,750 in purchasing power.

The combination of improved home affordability and substantially more inventory than the last several spring selling seasons should lead to an increase in home buyer demand. Buyers, what are you waiting for? It is time to get off of the home buying fence and cash in your chips.

If you want to buy a house in the near future and don’t know where to start, check out these links that will point you in the right direction.

Pre-qualified versus Pre-approved

Down payment and closing costs

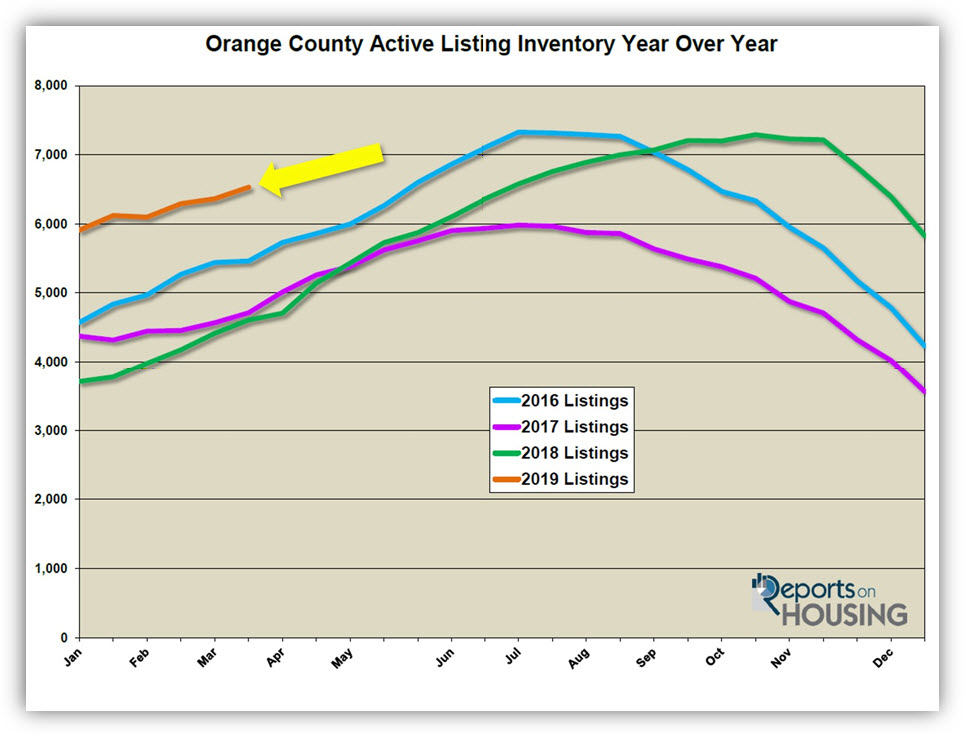

In the past couple of weeks, the active inventory increased by 3%. In the past two weeks, the active listing inventory increased by 166 homes, up 3%, and now totals 6,532, the highest level since November last year. The inventory had been slowly rising, most likely due to the torrential rain that Southern California had experienced. Since much of the heavy rain is over, and now that is officially spring, more homeowners are opting to place their homes on the market. The increases will gain momentum in the coming weeks, the busiest time of the year for housing.

Last year at this time there were 4,609 homes on the market. That means that there are 42% more homes available today. This is the highest level of homes on the market for this time of the year since 2012.

In the past couple of weeks, demand increased by 3%. Demand, the number of new pending sales over the prior month, continued to rise, increasing by 78 pending sales in the past two weeks, up 3%, and now totals 2,350. The rapid increase in demand from the start of the year is starting to slow and will most likely only increase slightly until peaking sometime in May. From there, demand will slowly diminish through the rest of the Spring and Summer Markets.

The retreat in interest rates this year has helped demand considerably. Soft demand had been an enormous issue in the second half of 2018, but with falling rates demand has picked up.

Even with the strong increase in demand, it is important to note that the current demand reading continues to be the lowest for this time of the year since 2014. There still is buyer apprehension in approaching the housing market. They are careful not to overpay and are looking to offer only the Fair Market Value for a home. They are not willing to stretch the asking price, which is why homes are currently not appreciating much at all.

Last year at this time, there were 188 additional pending sales, 7% more than today.

How to prepare your house for sale

The luxury inventory climbed quite a bit. In the past two-weeks, demand for homes above $1.25 million increased by 6 pending sales, a 2% increase, and now totals 352, its highest level since the end of June 2018. The luxury home inventory increased by 76 homes and now totals 2,090, a 4% increase. The overall expected market time for homes priced above $1.25 million increased from 175 days to 178 over the past two-weeks, a slight increase.

Year over year, luxury demand is down by 1 pending sale, basically the same as last year, and the active luxury listing inventory is up by an additional 293 homes, or 16%. There is a lot more seller competition so far this year. The expected market time last year was at 153 days, better than today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the expected market time increased from 95 to 103 days. For homes priced between $1.5 million and $2 million, the expected market time increased from 140 to 146 days. For homes priced between $2 million and $4 million, the expected market time decreased from 245 to 230 days. For homes priced above $4 million, the expected market time decreased from 650 to 562 days. At 562 days, a seller would be looking at placing their home into escrow around the start of October 2020.